Book review: “Rich Dad Poor Dad” is a step up from conventional personal finance wisdom

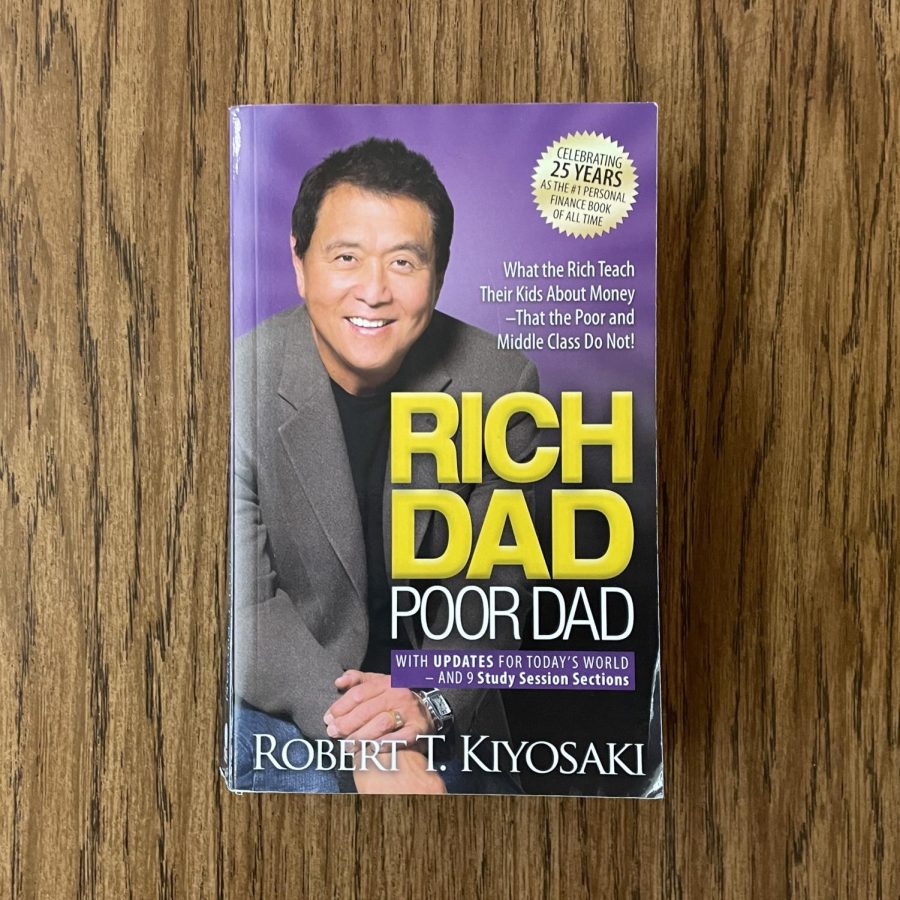

“Rich Dad Poor Dad” has sold over 44 million copies globally and ignited a movement of personal finance education that exists to this day. Photo by: Alejandro Hernandez

January 24, 2023

The 1997 book remains relevant over 25 years later

“Rich Dad Poor Dad” is a book by businessman Robert Kiyosaki. The book is a set of parables written to anecdotally illustrate the importance of personal finance education and how it can be achieved. Its most prominent parable involves the dichotomy between Kiyosaki’s rich dad, his childhood best friend’s wealthy father, and Kiyosaki’s poor dad, his highly educated biological father. The juxtaposition of Kiyosaki’s relatively uneducated yet rich dad and his highly educated yet poor dad expands on the book cover’s statement, “What the Rich Teach Their Kids About Money–That the Poor and Middle Class Do Not!”

“Rich Dad Poor Dad” is divided into nine chapters, with study session chapters to summarize each. Each chapter has its respective lesson as its title. In chronological order, these lessons are “The rich don’t work for money,” “Why teach financial literacy?” “Mind your own business,” “The history of taxes and the power of corporations,” “The rich invent money,” “Work to learn–don’t work for money,” “Overcoming obstacles,” “Getting started” and “Here are some to dos.”

Mateo Navarro ‘23 said, “[I read ‘Rich Dad Poor Dad’] during my sophomore year. Most people may be motivated to follow the plan to financial literacy in ‘Rich Dad Poor Dad,’ but barely anybody has the discipline to keep the consistency of what the book tells you to do, which is the most important part.”

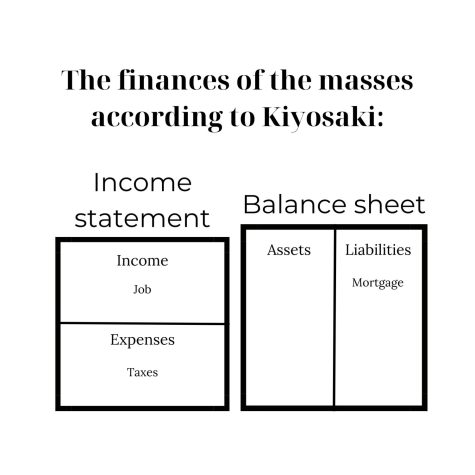

The chapters follow Kiyosaki’s entrepreneurial journey from the 1950s to the 1990s, as well as how he adopted his rich dad’s lessons in business. The book’s greatest achievement is facilitating a paradigm shift from the conventional wealth-building advice of selecting a high-paying career to acquire assets. Kiyosaki notes that most people don’t have assets, and worse yet, they don’t know what an asset is. The distinction between income and assets, as well as what counts as an asset, is a critical prerequisite to understanding “Rich Dad Poor Dad.”

According to page 85 of “Rich Dad Poor Dad,” “An asset is something that puts money in my pocket whether I work or not. A liability is something that takes money out of my pocket… If you want to be rich, simply spend your life buying or building assets. If you want to be poor or middle class, spend your life buying liabilities.”

Kiyosaki simplifies financial concepts, and rightfully so. He sagaciously wrote “Rich Dad Poor Dad” as an introduction to financial literacy. Therefore, its concepts are simplified to an elementary level. Kiyosaki notes the difficulty in financially educating people because they’re trained to be thorough, specific and nuanced. Instead, Kiyosaki believes people should unlearn and relearn through a child’s lens. It is a stroke of brilliance, as the concept has been demonstrated in foreign languages, where high school and college students learn elementary-level languages which are unknown to them. Unfortunately, many have low financial literacy and education, which can be combated by open-mindedness and a willingness to remove incorrect conventional wisdom from their canons.

Evan Brehm ‘24 said, “[VHS has] the classes of health and college and careers, [but] they should have a semester class dedicated to money education, and it should be mandatory.”

Kiyosaki’s book may be solely intended for educational purposes, but it is also significant in its social commentary. The book demonstrates the ineptitude of the current education system in educating students on finances. While Kiyosaki is supportive of education, he is skeptical towards the conventional approach of being an employee for life who is taken care of by the company or government. Kiyosaki’s book is a firm testament to the importance of self-reliance, particularly as the riches of the post-World War II era spoil.

It is simply not enough for the masses to rely on high school money management classes, as it is not advantageous for the system to empower its peons. It is up to every young person to seek extra-educational personal finance development such as “Rich Dad Poor Dad.”

![Lindsay Guzik, new assistant principal said, "I am settling in [at VHS] pretty well. I know a lot of the students, so that makes it a little bit easier coming from Cabrillo, and it's been nice to see them all grown up." Photo by: Abraham Kassa](https://thecougarpress.org/wp-content/uploads/2025/09/IMG_9728-300x200.jpg)