Exploring the world of politics the US is entering

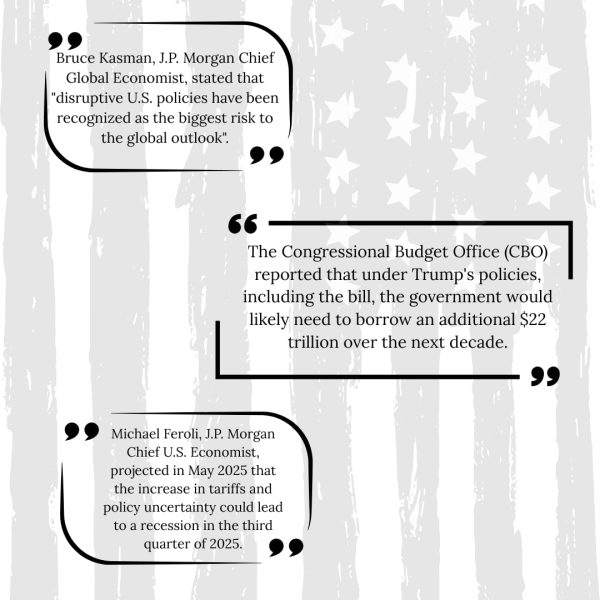

The “One Big Beautiful Bill” introduces changes to the existing tax codes that will have an impact on Americans nationwide, including parents and students as they enter the work force. This legislation aims to streamline tax processes, revise tax brackets and provide deductions and credits to taxpayers. With its provisions and implications, the “One Big Beautiful Bill” has raised both excitement and concerns among individuals and businesses alike.The entire bill is over 140 pages long.

Insights on specific aspects of the “Big Beautiful Bill” and its implications for taxpayers are mixed.

Anastasia Dominguez ‘26 said “Depending on what I want to do I can see some of these sections as valuable but also as damaging. I can see the no tax on overtime helping me with early life as I’m trying to make money but a lot of these are damaging to the environment which has me worried about the near future.”

Frankie Lopez ‘27 said “ICE doesn’t need more funding. We the Mexican public need the funding. We all need to step up for our community.”

The bill includes, but is not limited to, the following sections:

Section 10101 – The Thrifty Food Plan serves as the foundation for determining the maximum Supplemental Nutrition Assistance Program (SNAP) benefits per person. The re-evaluation aims to limit the USDA’s flexibility in adjusting SNAP benefits through T.F.P by imposing a cost-neutral requirement and removing the mandatory five-year reevaluation cycle. This proposal has been met with opposition from groups like the Food Research & Action Center and the Center of Budget and Policy Priorities.

Section 10102 – This modifies SNAP (Supplemental Nutrition Assistance Program) work requirements for able-bodied adults. It expands the age range subject to work requirements from 18-54 to 18-64 and parents with children over a certain age (previously 18, now potentially 14 or older) must also meet work requirements. Additionally, the bill limits the availability of waivers for these work requirements, only allowing them for areas with high unemployment rates and income.

Section 10107 – The National education and obesity prevention grant program SNAP-ED provides: Free nutrition education, cooking demonstrations, and workshops to help SNAP participants make healthy food choices and be more physically active. Section 10107 will end funding for this program after the 2025 tax year.States are currently being asked to close out their 2025 SNAP-ED grants and return unspent funds.

Section 10108 – This will restrict SNAP eligibility primarily to U.S. citizens and Lawfully permanent residents (LPRs or green card holders) with some exceptions. These exceptions are Cuban or Haitian entrants,Citizens of the Marshall Islands, Micronesia, and Palau. It will exclude Many Lawfully Present Immigrants: This explicitly removes eligibility for several categories of lawfully present immigrants who were previously eligible for SNAP, including Refugees, Asylees,Victims of trafficking, People granted withholding of removal, Certain survivors of domestic violence under the Violence Against Women Act (VAWA) and Individuals granted humanitarian parole for at least one year.

Sections 50101 and 50102 – The National Taxpayers Union says restoring a 12.5% royalty rate and mandating quarterly lease sales while making the process easier by eliminating Expression of Interest fees and limiting environmental review. It also extends the permit to drill terms to four years. Section 50102 on offshore leasing requires numerous lease sales, including 30 in the Gulf of Mexico between 2025 and 2039 and 6 in Alaska’s Cook Inlet by 2028, overriding previous plans.

Section 60001 – The act will revoke unobligated funds from the Clean Heavy-Duty Vehicles program established under the Inflation Reduction Act. This program aimed to provide and accelerate the replacement of existing combustion engine and heavy-duty vehicles with zero-emission vehicles. This means roughly $454 million that was available for projects like replacing school buses, trash trucks, and delivery trucks with zero-emission alternatives, has been taken back.

Section 60002 – The funding for projects aimed to reduce greenhouse gas emissions, including those focused on environmental justice and climate pollution reduction, will be eliminated. The bill also rescinds unobligated funds from other programs like the EPA’s Environmental Justice Block Grants and Climate Pollution Reduction Grants.

Sections 60003-60006 – This was proposed to revoke unobligated funding for various environmental programs, including those focused on reducing diesel emissions, general air pollution, air pollution at schools, and low-emission electricity initiatives, These rescissions target previously appropriated funds that have not yet been spent by programs established under the Inflation Reduction Act.

Section 70104 – This is a central component of the broader One Big Beautiful Bill Act, which implemented a number of tax changes. The provision addresses the scheduled expiration of the Tax Cuts and Jobs Act (TCJA) tax cuts and aims to provide long-term financial relief for families.

Section 70201 -This allows eligible workers to take a tax deduction of up to $25,000 for qualified tip income, effective for the 2025 – 2028 tax years. This is not a full tax exemption. Tips are still subject to Social Security and Medicare taxes, and standard income tax withholding is not changed.

Section 70202 – “No tax on overtime” This measure does not make overtime pay completely tax-free but offers a deduction for a portion of the earnings. The deduction is for non-exempt employees who receive overtime compensation required under the Fair Labor Standards Act. The deduction is capped at $12,500 for individuals and $25,000 for those who are married and filing jointly. The deduction is available to taxpayers regardless of whether they itemize deductions. It’s reduced for taxpayers with a modified adjusted gross income over $150,000. No tax on overtime has yet to take effect.

Every tax bill can change the United States after it is passed. The full bill can be found online at https://www.congress.gov/bill/119th-congress/house-bill/1/text which provides all acts that have been passed. More information is available online.