On Nov. 6, city council leaders, school board members and propositions are being voted on. One of these propositions is Proposition Six, which addresses whether the gasoline tax should stay or be eliminated. To sum up the two arguments, voting “YES” pushes to eliminate the recent California gasoline tax increase, making gasoline prices cheaper and give voters the ability to have a say in future changes regarding state gasoline taxation. However, funding for highway and road maintenance and repair and transit programs would decrease if Proposition Six Passes. Voting “NO” pushes to keep the established gasoline tax to fund highway and road maintenance and repair and transit programs but voters wouldn’t have a say in future gasoline tax changes.

One aspect that an individual can choose to consider when going over Proposition Six, is the relationship between environmental degradation and vehicle use.

The existing environmental externalities – or unintended effects on the environment – of automobiles are the components that are attached to an automobile that affect the environment, but are not accounted for in the costs of vehicles or fuel. Some examples of externalities are carbon dioxide (CO2) emissions contributing to climate change, air conditioner coolants contributing to the depleting ozone layer, oil polluting groundwater, toxic materials released into the environment and roads paved over open land.

Although difficult to find the total sum of costs of their environmental impacts, it is possible; however, they are not attributed to the costs of vehicle and fuel payments.

AP Environmental Science teacher Jared McEntyre shared an example of how another country has instituted a tax on carbon emissions to make up for the environmental impacts those emissions bring, explaining that Canada recently created a carbon tax that raises the cost of emitting carbon dioxide and other greenhouse gases, thus creating an incentive for industries and individuals to reduce their pollution.

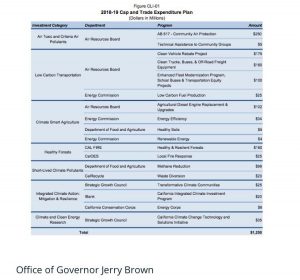

According an article from Grist, “California makes big money from its carbon pricing program. Who gets it?” Governor Jerry Brown announced a $1.25 billion plan that “would put millions of electric cars on the road, cleaner tinder from the state’s flammable forest, and replace exhaust-belching motors with cleaner engines.” The money coming from California’s carbon cap goes into its own account, not into the “general fund.” However, critics believe it is unable to do enough “for Californians hardest hit by fossil-fuel pollution.”

Courtesy of Grist

Furthermore, according to an article from The Guardian, “EPA’s war with California proves America needs a carbon tax,” the United States Environmental Protection Agency under the Trump Administration threatened to “repeal the vehicle fuel efficiency standards set under the Obama Administration and replace them with weaker requirements.” To further elaborate on the possible implications of this repeal, the United States has the second-cheapest gasoline prices among all developed countries other than Russia. Next in line would be Australia with gasoline prices 35 percent more expensive, Canada with prices 46 percent more expensive and European petrol with about twice the price of United States gasoline. This can lead one to believe that these cheap gasoline prices in the United States can be one of the many attributing factors to the high levels of carbon dioxide emitted in the US.

Per The Guardian, a carbon tax would likely be beneficial not only to the environment, but the United States’ economy: “The stricter standards would save $1.7 trillion on fuel by 2025; buying inefficient cars would cost Americans money.” A carbon tax has the potential to “increase consumer demand for fuel efficient cars,” “protect US automakers the next time gasoline prices spike,” “generate tremendous revenue that would be used in a variety of ways” and return the revenue partially or entirely back to the taxpayers, they argue.

McEntyre went on to explain how it is possible for there to be external costs associated with climate change that originate from CO2: “More carbon in the air leads to less coral reefs [due to higher acidity levels in the oceans], then those countries that have beautiful coral reefs and all the biodiversity that coral reefs have, they would potentially lose dollars in tourism. Or if we have increased temperatures, we’ll have increased evaporation, more serious drought conditions. Well there’s economic considerations associated with those. Loss of crops, loss of food, increased flooding, all these things have a cost, so whoever is doing the damage should pay the cost, that would make them want to do the damage less.”

By looking at the big picture with the state of our environment in mind, voting “YES” would give people access to cheaper gas, therefore more people would be less conscious of their usage. However, it does give voters the chance to have a say in future gasoline and vehicle taxes, which could have the ability to spark a possible carbon tax instead.

A “NO” vote keeps the price of gasoline higher, which has the ability to reduce the amount of carbon dioxide that people release by driving their cars more. Since gasoline is more expensive, people are likely to look for alternatives to save money. However, the money earned from the taxes goes to only highway and road maintenance and repairs and transit programs.

McEntyre shared, “In terms of the gas tax, I would suggest that we move to a gas tax that goes to fund losses due to climate change, and furthermore, to get fiscally conservative people on board, it should be revenue neutral… meaning everyone is going to get an equal share of the money back.” He added, “We want to have gas tax that is supported by both environmentalists and fiscally conservative individuals.”

The vote on Proposition Six can be approached as more than just a decision between cheaper gasoline or safer, better maintained roads, but either decision has the potential to impact the environment in different ways.